Click here to see how I answered my Summons for less than $20

Motion to Strike Credit Card Agreements in Credit Card Debt Lawsuits

Can you strike the credit card agreement attached to your lawsuit if it is irrelevant to your case?

I have posted many items in regards to my credit card debt lawsuit with Capital One but let’s get into why I did this and if it worked in case you did not read any of those previous posts.

I opened a credit card with Capital One in 2002 and sadly defaulted on that card in 2003. I know it was bad but what are you going to do when you have no money to pay? I was sued in 2009 and Capital One attached their card agreement with the lawsuit but I noticed the copyright date of 2005. My account was closed in 2003. This agreement had nothing to do with my account that I opened in 2002. I found it unbelievable that they could attach an agreement which is 3 years older than the agreement that I agreed to.

Credit card agreements contain a lot of terms which you agree to. So in my defense I wanted a copy or the original agreement with a copyright date of 2002 not 2005. So I chose to file a motion to strike the 2005 credit card agreement as being irrelevant to this lawsuit. How does a 2005 agreement prove that I agreed to all of these exact terms back in 2002? It does not.

The lawyer from Capital One snapped my head off in a little office in the courtroom, telling me that I was wrong and all of their card agreements are the same. I told him to prove it. Just because he says so doesn’t make it a true fact. I want the 2002 agreement, not a 2005.

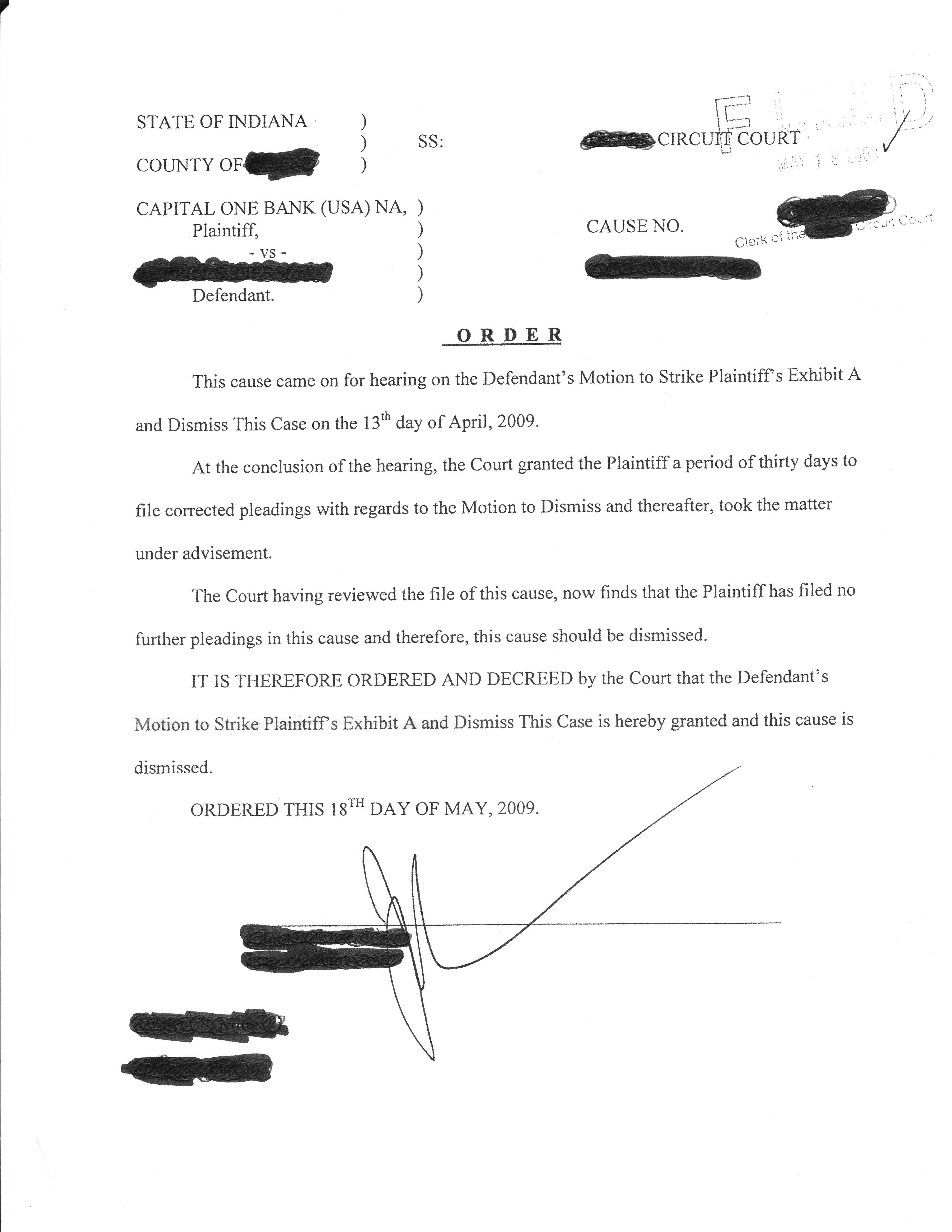

I wrote up a motion to strike the 2005 agreement and won my entire case based on Capital One not being able to provide the correct dated agreement which pertained to my account.

So, does a motion to strike a credit card agreement work for a credit card debt lawsuit? Absolutely. I have said this time and time again and will say it again: Anytime you have a gut feeling or just know something does not make sense with your credit card debt lawsuit, always go with your gut, and defend yourself. The worst that can happen is that your motion is denied and the case continues. It is a lot better than letting these attorneys get away with things that are not right!

My motion to strike went a little like this:

To strike Plaintiff’s Exhibit A because the customer agreement submitted by Plaintiff has a copyright date of 2005 and Plaintiff’s Exhibit B, monthly billing statements, do not show Defendant having any account open in 2005. The 2005 customer agreement submitted by Plaintiff has no bearing in this action. The fact that Plaintiff issued a particular agreement with particular terms is of little relevance in determining the actual terms of the alleged agreement before this court. At bar, Plaintiff who has submitted a copy of a customer agreement has failed to provide the actual terms and conditions agreed to by Defendant.

Not too shabby for a Pro Se defendant! The judge told Capital One to come up with the 2002 agreement and that they had 30 days to do so. Well, they never did. Therefore, I won.

I have beaten Capital One among many junk debt buyers and I really hope to help many, many more of you out there who are being sued! Click here to learn how I did it.

My Ruling

Related Posts