Click here to see how I answered my Summons for less than $20

I Beat Capital One Lawsuit

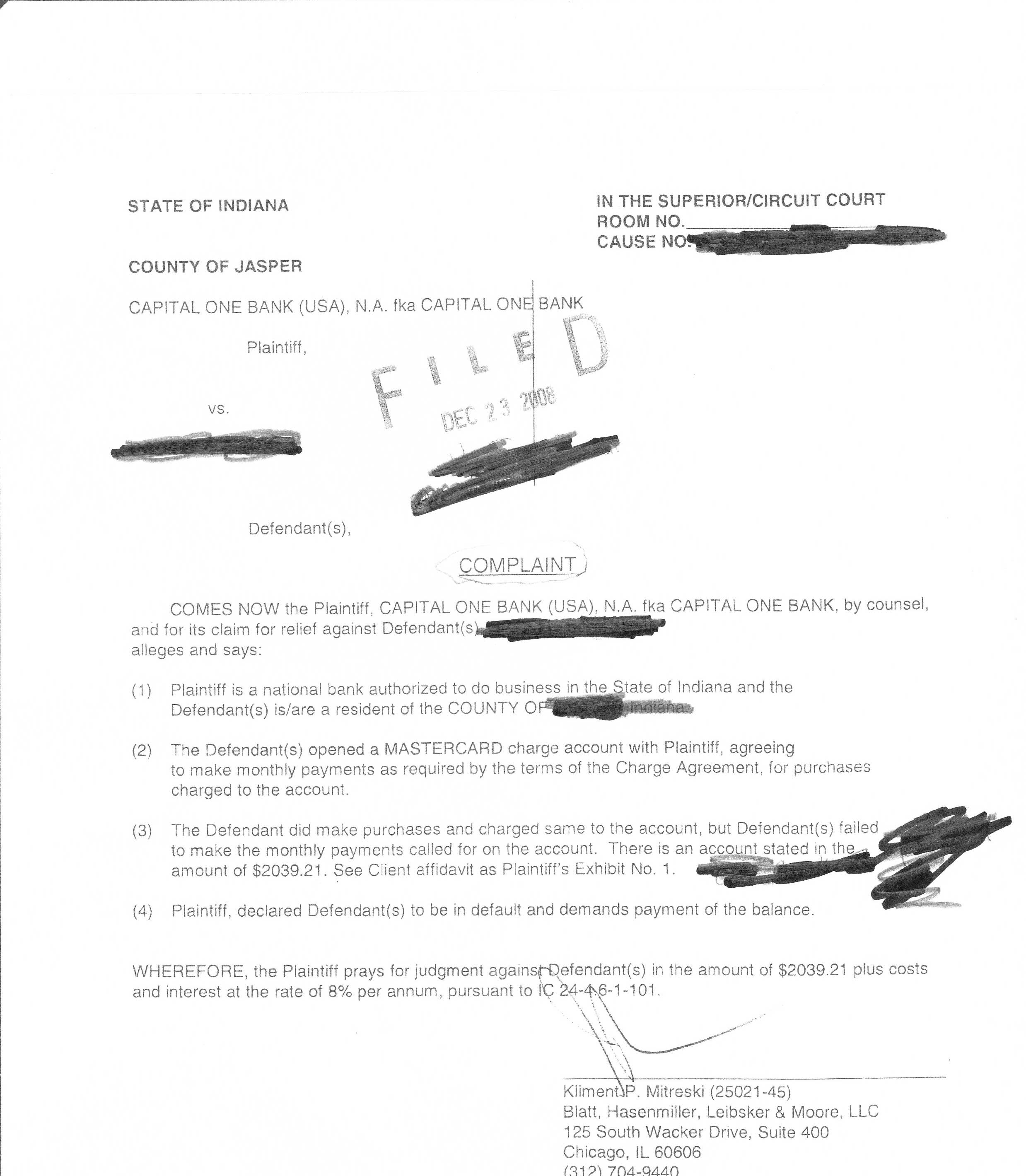

When I was sued by Capital One in December, they attached an affidavit of debt but no contract.

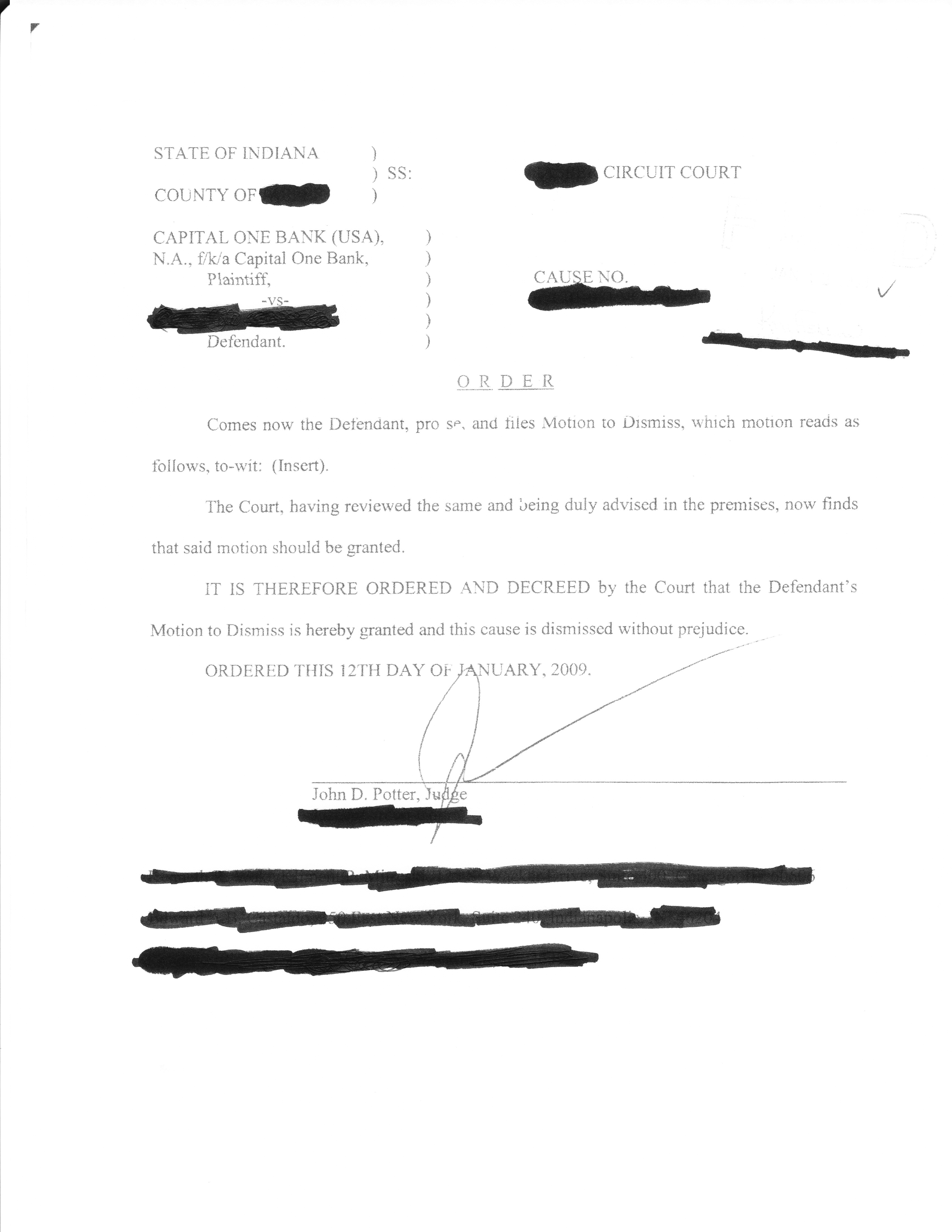

I filed a motion to dismiss case for not attaching the contract which was granted without prejudice.

Capital One filed a motion for extension of time to comply (attach contract).

When they supposedly complied, they added all monthly billing statements and a customer agreement dated from the year 2005.

I did not have an account open with Capital One in 2005, therefore, the customer agreement was irrelevant.

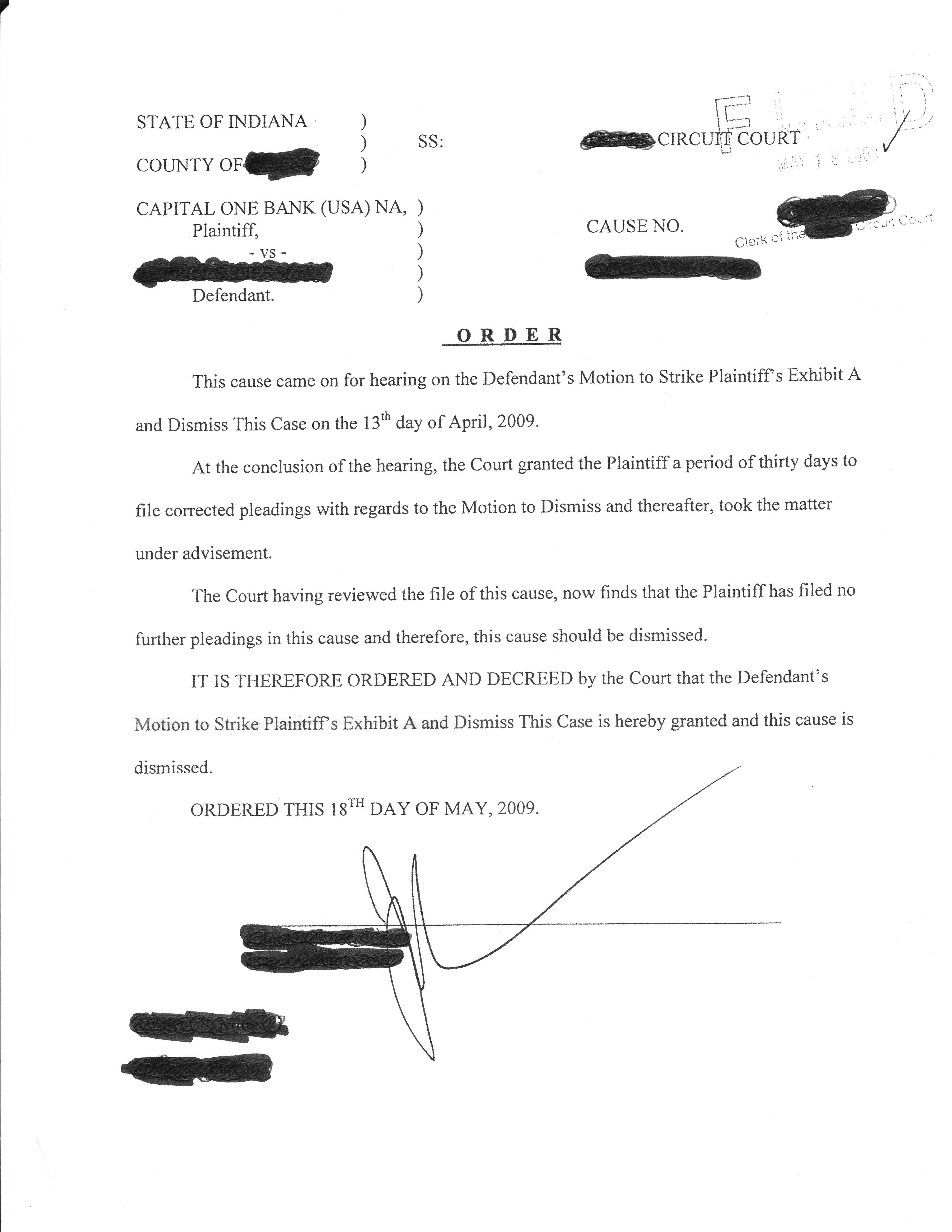

I filed a motion to strike the customer agreement for being irrelevant to dismiss the case with prejudice because they still failed to comply (attach the contract).

The hearing was set and the court gave Capital One 30 days to amend their pleadings and then the court would take my motion to strike and dismiss the case with prejudice under advisement.

30 days went by and they failed to comply again and this case was dismissed with prejudice by the court.

Before the hearing, the attorney brought me into a room and told me that my motion to strike was basically not going to hold and that the 2005 agreement and 2002 agreement were the same and that I should settle.

I told him to prove they are the same and that my motion to strike was not denied but was taken under advisement. The attorney knew that he would have to come up with that 2002 agreement and couldn’t do it so it was dismissed.

To read more about this story and get the court documents that I used to win this case, click here

The moral of the story is: if you are being sued, make sure that the customer agreement that has been filed by the plaintiff is the year that you had an account open with the creditor.

How I beat Capital One in court

Related Posts