Click here to see how I answered my Summons for less than $20

Answer Credit Card Lawsuit Motion to Dismiss

Have you been served by a junk debt buyer or collection agency?

It’s unwise for you to settle with them or simply ignore the summons so they come after you legally with a judgment, not to mention destroy your credit for the next 10 years! You need to answer the summons before they get a default judgment against you and then legally freeze your bank account and garnish your wages. Do not assume that just because they are suing you that they can prove they own the debt.

Junk debt buyers and collection agencies all have one thing in common – they are looking for a default judgment against you or they want you to panic because you’ve been served and rush, without thinking, and settle the debt.

They buy your old debt from your original creditor for pennies on the dollar. They then tack on interest, attorney fees, late fees and so much more and sue you for that inflated amount.

They assume that you are stupid and will just call them and settle, or simply ignore the summons and that will give them the win by means of a A default judgment.

With a judgment in hand they will freeze your bank account and get an order to have you come to court for a garnishment hearing. They may even bring you to court to ask you which bank you have your account with.

My question to you is this:

If you don’t answer your summons, you are going to end up in court for a garnishment hearing or for them to find out where you bank, so why wouldn’t you just answer your summons?

Are you considering settling with them?

If these companies are sitting there with no proof whatsoever, are you actually considering settling with them? You have rights. Don’t forget to use them. What proof have they given you that they can legally collect that money from you? Have they proved to you that they own the debt?

Do you know for sure that if you are being sued by the original creditor that it’s just not the junk debt buyer using the original creditor’s name as the plaintiff? Watch your back because these guys are sneaky. It’s true that sometimes they use the original creditor’s name as the plaintiff when it really is them suing you.

How do you know that once you settle up with them, another collection agency won’t sue you for the same debt? They don’t care. Then you’ll have to go to court again to prove you paid it the first time. You need to protect yourself from future lawsuits of the same debt!

If you think you should settle the debt, you need to think twice.

If they are sitting there with no proof whatsoever, are you actually considering settling with them? You have rights. Don’t forget to use them. What proof have they given you that they can legally collect that money from you? Have they proven to you that they own the debt?

Do you know for sure that if you are being sued by the original creditor that it’s just not the junk debt buyer using the original creditor’s name as the plaintiff? Watch your back these guys are slime. They do that you know, they use the original creditor’s name as the plaintiff when it really is them suing you.

How do you know once you settle up with them, another collection agency won’t sue you for the same debt? They don’t care. Then you’ll have to go to court again to prove you paid it the first time. You need to protect yourself from future lawsuits of the same debt!

You need to take a deep breath and think about the following:

- Almost all junk debt buyers do not have any proof.

- Almost all junk debt buyers do not have the original contract.

- Almost all junk debt buyers do not have the assignment.

- Because almost all junk debt buyers do not have the original contract, credit card statements or the customer agreement for that matter, they will submit, as evidence, an affidavit of debt which is false and can get thrown out of court in a heartbeat. Did you know that? Their affidavit isn’t worth the paper it is written on

- Almost all junk debt buyers do not have any proof whatsoever to prove, in a court of law, that they can legally sue you or that they do own that debt.

Are you going answer your summons and fight them back?

What if you settled with them for $5000.00 and later learned these companies didn’t actually have any proof?

To see what they’ve got on you, and to not get a default judgment against you, answer your summons, especially if there was no evidence submitted with their complaint. That is a big giveaway that they don’t have anything to support their suit. If you received just a complaint with nothing else, that’s probably all they have and they figure you’ll just fold when you see the summons and default.

I was sued for over $8,000.00 from LVNV Funding LLC.

I was just like you, served with a summons and didn’t know what to do. I researched for countless hours and finally beat them! I have put a package together based on my research and put all of these samples together. I am not an attorney nor am I giving legal advice; I am providing information. All courts have different rules of procedure. Always follow your court rules. This package is for informational purposes only.

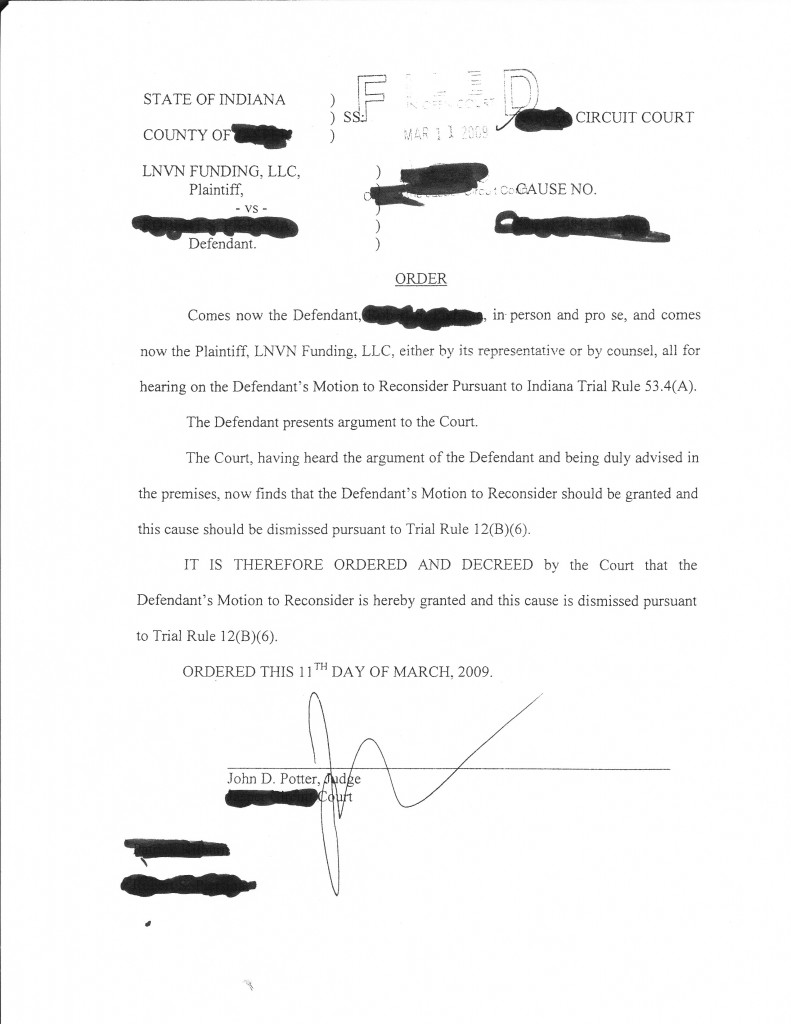

My Case was dismissed! (see proof below)

Once you file your answer, your case will either continue with a court date set where the junk debt buyer doesn’t show up, or they most likely will drop it then and there because they don’t have the money or the time to fight back. If the case continues, you will have all the ammo you need to fight them back.

Affidavit of Debt

For all of you who have been served by a collection agency and only an affidavit of debt was attached, you will have the upper hand to motion the court to strike the affidavit from the record and once this affidavit is struck from the record, they will not have any evidence whatsoever. Affidavits are given when a junk debt buyer has no other evidence to support their claim. If this is struck from the record, there is no evidence and no claim: case dismissed.

Save hundreds of hours of research and see my own research that I used to have my case dismissed. My case was dismissed for failure to state a claim upon which relief can be granted. This means they had no LEGAL case against me and that they had nothing there in order to sue me, so it was thrown out.

Here are the Samples You Will Receive:

- Notice of appearance: This lets the court know that you are appearing and actively participating in this lawsuit. It also gives you the right to receive each and every document, motion, and order that the court and the plaintiff file so that you are not left in the dark and know exactly what is going on with your case. This basically ticks off the collection attorney because now he knows you mean business. I filed this when I filed my answer with the court.

- Answer to the summons: When you answer the plaintiff’s complaint, you must either affirm or deny each paragraph. I have listed 6 responses I used for each of the plaintiff’s counts against me. What you will do is read your summons and pick and choose from the responses that are provided. All of these responses to the plaintiff’s complaint are related to credit card lawsuits so you will find something for each one.

- 12 Affirmative defenses: When you answer the complaint you must list affirmative defenses. These are necessary when you file your answer with the court. If you do not list any affirmative defenses, you waive them and can lose. They must be listed. Let’s say you found something wrong with the case down the line and didn’t list them in your affirmative defenses, most courts will not allow your new findings because you did not list them in your affirmative defenses. These affirmative defenses are a must have in any credit card lawsuit! These defenses protect you.

- Certificate of service: Everyone must use a certificate of service. This is a statement at the bottom of all your pleadings and motions that states that copies of what you are filing with the court have been mailed to the plaintiff. Most do not know that this needs to be included. The plaintiff must receive every single piece of paper you have filed with the court. The plaintiff must also do the same for you.

- Motion to strike affidavit of debt: if you received an affidavit of debt with your complaint, this alone, if uncontested, is enough for them to get a default judgment against you. If you have not received an affidavit of debt with your complaint, expect one to show up. This motion to strike is the ultimate weapon to destroy any junk debt buyer’s case! I have prepared a sample motion to strike affidavit of debt and have listed eight legal reasons why the junk debt buyer’s affidavit should be struck from the record. (Without this affidavit, their entire case is faulty. Most do not have the original contract or credit card statements and use affidavits of debt to get by your trial rule).

- Sworn denial: I have written up a sample sworn denial that is a powerful tool to get the affidavit eliminated! Once the affidavit is eliminated, the lawyer will be forced to bring in a live witness to testify which costs money and they don’t want to spend any money. Most just drop the case then and there.

- Response to interrogatories: Responses I used for my own interrogatories. Watch out for trick questions! They will ask almost the same question in a few interrogatories hoping you make a mistake! I have listed my responses which you can also use to answer the plaintiff’s interrogatories. Again, all of these responses are based on a credit card lawsuit so they can help tremendously. Pick and choose which ones best fit your Rogs.

- Response to admissions: Responses I used for my own admissions. Keep in mind that most courts do not allow you to just put “lack of information”. It needs to be worded correctly. So many people mess this up and just put “lack of information” and the plaintiff gets these deemed admitted to the court because they worded it wrong. I have included a response to use when the plaintiff sends you requests to admit facts. Yes, one simple response will allow you to answer admissions like:

- Response for production of documents: Responses I used for my own answer for production of documents. All requests are related to a credit card lawsuit. Pick the ones you need. Answers for requests for documents include:

- providing copies of all payments, copies of settlement letters,

- exhibits or evidence you plan on using, e.g. credit card statements.

- Request for documents to the plaintiff: I will give you all the documents that I requested to LVNV Funding per my lawsuit. There are 21 of them. I think that the more documents requested, the more work they have to do, and the more you tick them off!

- Request to admit facts to the plaintiff: I will provide you with the admissions I requested LVNV Funding to admit. There are 21 in all for you to sample.

- Interrogatories submitted to the plaintiff: I will provide you with all the interrogatories I requested from LVNV Funding per my lawsuit. There are 23 listed for you to sample.

- Included with the request for documents, request to admit facts and interrogatories: I have listed all the instructions, definitions, claims of privilege and lost or destroyed information that come before you submit your requests to the plaintiff.

If your case makes it to discovery, which is unlikely but just in case, I have thrown in:

*Responses include answers to questions about bank account information, social security number, payments made to original creditor, payments made to plaintiff, last check number written out to plaintiff or original creditor, payments made to account number XXXXX, the amount sued upon, settlements made to account, witnesses to be called to trial, factual basis of each defense, exhibits used at trial.

Please admit you applied to the original creditor for xxxx credit card, admit you made charges on the credit card, admit you agreed to the terms and conditions when you used the card, admit you are indebted to the plaintiff for $XXXX.XX, admit you made payments, admit you owe the balance, admit this is the correct balance.

All of the above information and samples all pertain to a credit card debt lawsuits and what I used to get mine dismissed. If you have been sued by a junk debt buyer, using my samples and information contained in all of the above can help you as well!

Don’t risk your bank account getting frozen or your wages being garnished. Don’t get a default judgement. Answer your summons now! If you can afford an attorney, please do so.

Attorneys can charge up to $250 for a consultation, and thousands more to defend. Most attorneys are looking for Fair Debt Collection Practices Act Violations and if they don’t find any, they tell you to settle, but you know better now, don’t you?

The cost of this package is a fraction of what an attorney charges, and if you cannot afford an attorney, this might help you. I know all of this helped me get my case dismissed!

To get The Defendant’s Package click here.

Related Posts